Top U.S. Microfabrication Foundry, Atomica, Raises $30 Million in Series C Financing

PRESS RELEASE

Atomica attracts capital from Cerium Technology Ventures, Novo Tellus Capital Partners, and St. Cloud Capital

SANTA BARBARA, CALIF. (PRWEB) November 08, 2022

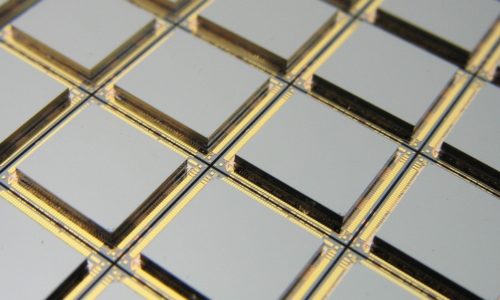

Atomica Corp, a leader of micro-electro-mechanical systems (MEMS), today announced a $30 million Series C financing. The round was funded by Cerium Technology Ventures, Novo Tellus Capital Partners, and St. Cloud Capital. The new financing allows Atomica to expand its foundry capabilities, advance MEMS technologies, and support domestic production of biochips, sensors, and photonic circuits.

Atomica is a pioneer in manufacturing Micro Electro-Mechanical Systems (MEMS). MEMS technologies leverage the precision and scale of semiconductor wafer manufacturing to make micro and nano-scale structures on silicon, glass, and other substrates to significantly improve the performance and economics of chips used for sensing and mechanical functions. Atomica is the leading U.S. MEMS foundry, partnering with innovative system-vendors and fabless device firms globally to bring new technologies to life.

"Atomica has differentiated itself as a world-class MEMS company addressing design, development, and fabrication solutions across the full spectrum of MEMS use cases that aim to solve today’s most pressing problems.” - Robert Lautz, Co-Founder of St. Cloud Capital,

“As highlighted by the recently passed CHIPS Act, the U.S. must re-establish leadership in semiconductor manufacturing including MEMS semiconductor chips for emerging applications such as genomics, cell therapies, molecular diagnostics, IoT sensing, and autonomous vehicles,” said Atomica CEO, Eric Sigler. “We are pleased to garner the support of new capital partners St. Cloud and Novo Tellus, as well as the continued commitment of Cerium. These investments aid our efforts to grow and protect domestic U.S. manufacturing of MEMS and related semiconductor technologies.”

“As sector investors, we invest behind long-term secular trends and innovative management teams who are passionate about their mission. We see that at Atomica and we are excited to support management in their growth journey,” said Wai San Loke, Co-Founder and Managing Partner of Novo Tellus Capital Partners.

Robert Lautz, Co-Founder of St. Cloud Capital adds, “We are extremely pleased to facilitate Atomica’s next chapter of growth in partnership with the management team, Cerium Technology Ventures, and Novo Tellus Capital Partners. Atomica has differentiated itself as a world-class MEMS company addressing design, development, and fabrication solutions across the full spectrum of MEMS use cases that aim to solve today’s most pressing problems.”

“Atomica is a very special company, uniquely positioned to capitalize on the enormous potential of MEMS technology. Cerium is delighted to increase our investment and participate in the exciting future of the company,” notes Cerium Managing Director, Eldon Klaassen.

To learn more about Atomica’s MEMS-based solutions in photonics, biochips, relays, switches, and sensors, visit atomica.com/applications-and-experience/.

About Atomica

Atomica Corp. (formerly Innovative Micro Technology) unleashes the power of Micro Electro-Mechanical Systems (MEMS) to help solve the great problems of our time. Utilizing a uniquely collaborative approach to development and manufacturing, it partners with innovative companies to deliver breakthrough MEMS-based solutions in cloud computing, autonomous vehicles, cell therapy, molecular diagnostics, genomics, 5G, the Internet of Things (IoT), and more. Atomica is the largest MEMS foundry in the USA, serving customers from its 130,000 ft2 manufacturing campus (including a 30,000 ft2 class 100 cleanroom) in Santa Barbara, California. The company is ISO 9001 certified and ITAR registered. Its extensive experience spans the full spectrum of MEMS, including photonics, sensors, microfluidic biochips, and other micro components.

About Cerium Technology Ventures

Cerium Technology is a venture capital firm that invests in technology for energy, IoT, and capital markets. The firm has created a unique and scalable process to find and evaluate opportunities for investment, design and execute investment transactions, create value with sound strategic and tactical direction, and generate extraordinary returns. For more information about Cerium, visit www.cerium-technology.com.

About Novo Tellus Capital Partners

Novo Tellus is a private equity firm focused on investments in the technology and industrials market. Headquartered in Singapore, Novo Tellus seeks to work with companies and management teams to create long-term equity value by applying its investing and operating experience. For more information about Novo Tellus, visit www.novotellus.com.

About St. Cloud Capital Partners

St. Cloud Capital is a Los Angeles, CA-based private investment firm that provides growth capital to the lower middle market (companies with annual revenues generally between $10 million and $150 million) throughout the United States. St. Cloud typically invests $5 million – $20 million in companies across a wide range of industries in every layer of the capital structure, including senior secured debt, subordinated debt, and preferred and common equity. St. Cloud’s investment discipline includes non-control and control investments and involves partnering with strong management teams or experienced industry entrepreneurs. For more information about St. Cloud Capital, visit www.stcloudcapital.com.